An aspirational budget, with changes to improve revenue

THE 2020 National Budget that was recently passed in Parliament, had a record expenditure of K18.6billion and record revenue of K14.1billion. Below is an analysis by Kina Bank Group of the 2020 money plan for the Government.

The 2020 Budget envelope is K18.726 billion, with K14.095 billion in Revenue and K4.631 billion in Deficit net financing.

This Budget signals the largest Budget deficit and promises reform in taxation to diversify the tax base.

The Government’s plans to diversify the country’s economic base by heavily investing in the non-mineral sector and enabling infrastructure projects.

Capital Expenditure is focused on linking agricultural hubs to markets in urban areas and regional centres through the Connect PNG program. Development partners and donor governments plan to support Capital Expenditure in wharves and jetties, upgrading airports and airstrips, and improving rural access to electricity.

Agriculture, fisheries, tourism and Small to Medium Enterprises (SME) have been given increased focus in the budget allocations.

Operational Expenditure is targeted at reducing the cost of service delivery, particularly emoluments to public service and Goods & Services spending.

Part of Goods & Services spending is the payment of arrears for capital works, utilities, rentals, and superannuation contributions. Having a five-year view in mind, the government aims to reduce the cost of the public service in the medium term.

Meanwhile, spending in education and the Tuition Fee Free (TFF) policy had its budget cut in half. Parents will now have to pay 50% of school fees for public schools traded off against the advent of the Higher Education Loan Program (HELP) for tertiary students. Although the HELP scheme is to be applauded we believe the unintended consequences of the cut to the TFF are being under estimated and will ultimately see the number of children in schools fall.

Especially when population growth is 3.1% per year, inflation is at 4.5% and expected to average 5.7%, while GDP growth is projected at 2% next year.

The added financial burden of school fees may have an impact on disposable income and consumption, which is likely to spill over into economic performance and revenue collection.

Expenditure Targets

With an aim to form a foundation for fiscal reform that is expected to see lower costs by FY23, the Expenditure Targets in the Budget include:

- Reduce Operating Expenditure, including debt servicing, from 14% of GDP to 10% in the medium term.

- Bring down the cost of the Public Service from 16% of non-resource GDP to 10.6% in the medium term.

- Increase Capital Expenditure from 5.6% of GDP to 6.8% in the medium term.

- Begin paying K2.5 billion in Government arrears for rentals, utilities, superannuation payouts, and goods & services.

Policy Changes

Policy Changes

Taxation amendments and revenue policies for implementation in FY20 include:

- Increased alcohol and cigarette excise by 10% and restarting the indexation of these goods to CPI for an incremental increase every six months from 1 December 2019.

- Accelerated tax increases on alcoholic beverages with exceedingly high alcohol concentration.

- Increase progressive tax duty rates on unprocessed logs.

- Enhance Land Lease Rental Payments

More policy announcements are expected to be made during 2020, including:

- Review of Bank Licensing Fees and implementing an Additional Profits Tax, as well as examining increases targeting foreign exchange spreads.

- Review Telecommunication Licenses and Universal Access Levy regime.

- Amendments to revise the Income Tax Act.

- Introduce SME taxation regime based on turnover thresholds.

- Tariffs on imports of refined petroleum products.

- Confirmation of a Capital Gains Tax at a probable rate of 15% with detail yet to be agreed.

Heavy excise taxes on alcohol and cigarettes would have a dampening effect on consumption of those products in the current economic environment and might lead to lower revenue collection from those sectors.

Heavy excise taxes on alcohol and cigarettes would have a dampening effect on consumption of those products in the current economic environment and might lead to lower revenue collection from those sectors.

A concern of one off levies that are targeted at industries is that they potentially stifle innovation, provision of services and growth of new competition. Furthermore, there is a large black market for homebrew beer and spirits around the country.

Forcing consumers to turn to these illicit markets may embolden producers and incentivise new entrants into the black market. The results could potentially be losses in revenue for the government, increasing black market and associated criminal activity, as well as increased cost of law and order.

Expenditure

Total budgeted Government Expenditure in 2020 is K18,726.44 million. This is an increase of 13%, or K2,200.6 million, from the 2019 Supplementary Budget. The 2020 National Budget increases both Operational spending and Capital spending.

Operational Budget

Operational Expenditure in FY20 is K12,746.4 million, an increase of K1,256.2 million from the 2019 Supplementary Budget. The main Operational expenditure exercises are Public Service rightsizing and the settlement of arrears.

The upkeep and costs associated with the Public Service continues to be the single largest expenditure burden for the Government. For every K1 the Government spends in FY20, K0.51 goes to the ~400,000 Public servants, while K0.49 goes towards the rest of PNG’s population according to the Treasurer Ian Ling-Stuckey.

Embedded in the spending of K5.672 billion on Compensation of Employees (COE) is one-off public servants’ retrenchment payment of K430 million.

Also captured in Goods & Services spending is the payment of Government arrears, with K300 million for arrears in Capital Works and K221 million for Rental & Utilities Arrears. These are done with the overarching objective of bringing the cost of the Public Service down from 16% of non-resource GDP in 2019, to 10.66% in 2023.

Capital Budget

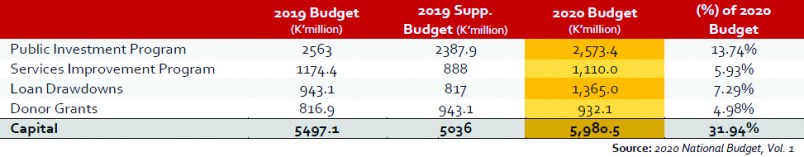

Capital Expenditure was allocated K5,980.5 million an increase by K944.5 million from the 2019 Supplementary Budget. Spending is focused overwhelmingly in the provinces, as well as other donor funded projects in health and infrastructure.

Provincial Support Improvement Program and District Support Improvement Program continue without amendment in FY20. The Government has committed K100 million each to the 2020 National Census and to Bougainville. K15 million has also been allocated for the PNG Games set to be hosted in the Southern Highlands Province.

Revenue

Revenue

Revenue & Grants in the Budget is expected at K14,095.4 million for FY20. This includes Tax Revenue (K11,161.5 million); Grants (K932.1 million); and Other Revenue (K2,001.9 million). Revenue & Grants increased by 7.6% from the 2019 Supplementary Budget.

Taxation

Collections from all major tax heads are projected to increase in FY20. Tax Revenue is set to grow by 6.8% from the Supplementary Budget to K11.161 billion.

The projections for Tax Revenue are based on the assumption of sustainable economic growth, albeit at a moderate pace. Personal Income Tax, Company Income Tax, Goods & Services Tax, and various excise taxes are expected to increase in the coming fiscal year. These are premised on increased economic growth in the non-mineral sector. We remain cautious about the extent of growth in the non-mineral sector in the absence of a major economic stimulus.

Import Excise and Mining & Petroleum Tax (MPT) are expected to decrease in FY20 by K21.8 million and K272.2 million, respectively. Lower collections for MPT are attributed to lower forecast prices for petroleum and mineral exports due to the slowing global economy.

Additionally, Infrastructure Tax Credits in previous years have reduced taxation obligations for mining companies in FY20.

Other Revenue

Other Revenue

In Other Revenue, the Government expects K2,001.9 million to be received from dividends, fees and charges, and the Public Money Management Regularisation (PMMR) exercise. Dividends from the Government’s interests in the mining and petroleum are expected to total K800 million in FY20. Meanwhile, State Owned Enterprises (SOE) and interests in the non-mining sector bear an expected divided of K250 million to Government in FY20.

There is a stated desire to revisit the privatisation of SOEs meaning the Government would need to prepare these assets and get them to a state that would attract private sector investment in order to achieve reasonable value. From this perspective, the SOEs will need to make the necessary reinvestment in their infrastructure, of which some is very old and requiring significant overhaul, and still be able to pay a dividend to the Government. This may prove challenging over the immediate future.

Grants

Grants

Total Donor Grants are expected make up 5% of the 2020 National Budget purse. Of the K932.1 million expected in Grant next year, K766.2 million comes from Foreign Governments and K153.2 million coming from International Organisations.

Financing

The 2020 National Budget results in the largest budget deficit in history. The K4,631.0 million net financing requirement is more than double that of the 2019 National Budget and increased by 32.2% from the 2019 Supplementary Budget. K757.2 million will be sourced domestically, while K3,873.8 million will come from external sources.

Domestic Net Financing

Domestic Net Financing

The Government expects to borrow from the domestic market in early 2020 while drawdowns of loans and grants are being finalised. Issuance of Government Inscribed Stocks will total K2.067 billion in FY20 to offset maturities, and K529.9 million as net financing. Treasury Bills issuances will be K9.6 billion leaving a net financing of K328.1 million after maturities. The government also expects to amortise K100.5 million in contingent liabilities and other accounts payable in FY20.

External Net Financing

New borrowing from external sources will be K6,106.9 million with amortisation of maturities of K2,233.1 million. Concessional Loans and Commercial Loans make up 22.4% and 15.8% of external borrowing, respectively. Net external financing for FY20 is K3.873 billion in FY20. Concessional financing takes up 25% of the Capital Expenditure component of the 2020 Budget. Concessional Loans from the World Bank is expected at K225.8 million in the final tranche of the Development Policy Operation budget support facility. The final tranche of the Asian Development Bank’s Health Sector Support Policy is expected to be drawn down with K322.6 million in budget assistance.

The Export Finance Australia budget support loan of K967.7 million announced recently replaces the proposed, and much delayed China Development Bank loan.

The Export Finance Australia budget support loan of K967.7 million announced recently replaces the proposed, and much delayed China Development Bank loan.

The largest component of external loan financing is coming from Extraordinary Loans at K3,774.2 million, or 61.8% of external borrowing in 2020. Details of this financing are unclear and leave open the requirement for domestic sources to finance a large portion of this gap.

One thought on “An aspirational budget, with changes to improve revenue”

Useful post! I really need this type of article.. this is very useful for me.

Comments are closed.